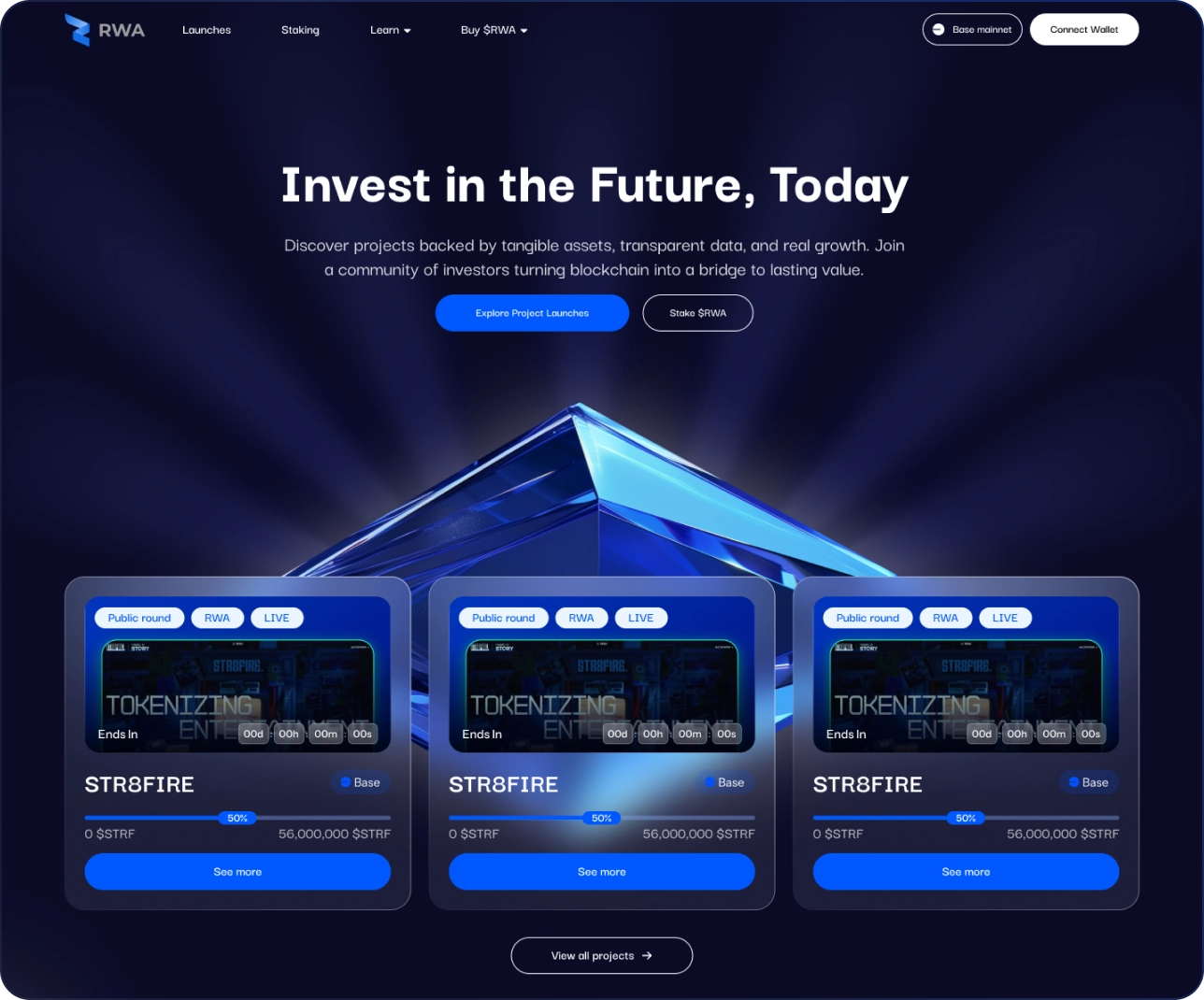

RWA Inc is a comprehensive blockchain infrastructure stack built for professional investors and asset managers to issue, distribute, and manage tokenized real-world assets.

$100M

tokenized assets

40+

countries of investors

500+

partners across the RWA stack

01

RWA platform

From frictionless onboarding to distribution, everything is wired for compliance, transparency and execution.

1

KYC, AML and legal structuring handled through our curated network of partners and regulators.

2

Create compliant tokens for your assets with audited smart contract templates and clear rights.

3

Access our marketplace, partner network and distribution channels to reach global investors.

4

Use our investor portal for ongoing updates, KPIs and governance in one secure interface.

Modular components for tokenization, loyalty, real estate and investor relations.

Optimized for curated deal flow with less than 0.5 % of projects accepted onto the platform.

Built for a 1 to 3 to 5 to 10 year horizon so RWA markets can grow on top of a stable foundation.

See how the platform works

02

Tier 1 only

03

Our track record

We focus on bringing our community of investors the highest quality private market deals.

$100M

tokenized assets

0.5%

of projects accepted

40+

countries of investors

500+

partners across the RWA stack

04

Future value

Your average investment per project

$5000

Number of invested projects per year:

10

Average annual return per project:

400%

Number of Investment years:

6

Total portfolio value:

$7,500,000

Total profit:

$7,200,000

Go to RWA INC Investor platform

05

Active pipeline

Explore active private market opportunities on our platform.

Tokenizing Hollywood IP rights to democratize access to film and media assets.

STR8FIRE

Decentralizing mobile charging networks across South Korea, with 13,000+ stations and 100,000+ batteries deployed.

PiggyCell

Bridging capital markets with tokenized energy and AI infrastructure in a $20T sector.

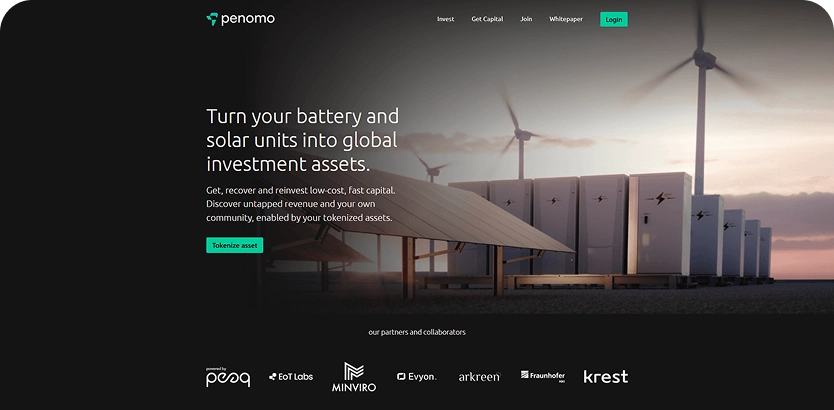

Penomo Protocol

Coming soon

06

Project quality assurance

Every deal goes through a rigorous due diligence process and then is voted upon

by our committee before it ever reaches our investors.

Seller and opportunity are assessed for credibility, asset provenance, and fit with our mandate before formal diligence begins.

Eligibility requirements, KYC/AML flows, documentation, and disclosure standards must be compliant with requirements of professional participation.

Key risks, valuation context, liquidity and exit considerations, and reporting expectations reviewed to ensure investors have clear decision-grade information.

Post-allocation updates, material event monitoring, and a consistent reporting cadence designed to keep investors informed over time.

Read our QA and acceleration requirements

07

Live on the platform

Curated private market opportunities for professional investors

seeking exposure to pre-IPO startup equity.

Real estate

Tokenized exposure to a prime Dubai development, combining utility access for residents with compliant digital securities for global investors.

Coming soon

Loyalty and commerce

A multinational retailer using the RWA Inc loyalty engine to connect on chain rewards with off chain spending across regions.

Coming soon

Explore Investment Opportunities

08

Ecosystem overview

All core components needed to issue, distribute and maintain real world asset

offerings, connected through one infrastructure layer.

Onboarding, structuring, smart contracts and issuance for compliant RWA offerings.

Front end layer for discovery and distribution of curated real world asset deals.

Compliant on chain loyalty that connects brands and users across physical and digital touchpoints.

Portals, reporting sites and KPI dashboards for top tier investors and stakeholders.

Stay up-to-date with RWA Inc. We value your inbox: no

spam, only important news and insights.

Sign up